What does the future hold for recruitment in the manufacturing industry? Well, we know a few things. We know there’s a shortage of skilled workers: job openings in the industry are hovering near all-time highs at 800,000, and 74% of manufacturing executives say that finding the right talent is a top-5 challenge. We know that recruiting teams struggle with talents’ negative perception of the industry: recent surveys suggest that talent isn’t aware of the digital transformation the industry has undergone (“Industry 4.0”)—let alone the considerable salaries and benefits that manufacturing companies offer.

We know that manufacturers struggle with diversity: women account for less than 1/3 of the manufacturing workforce; and the proportion of Black, Asian, and Latinx employees is even lower. We know that location is a sticking point for many candidates, so manufacturing companies are taking new shift work approaches and adding fluid shift timings to their EVPs.

But we wanted to know more. That’s why we surveyed nearly 100 talent acquisition professionals in manufacturing as 2022 came to a close: to get a collective sense of pain points, priorities, expectations, and goals; along with a shared sense of what 2023 might have in store. We asked about everything from tech stacks, to headcount plans, to diversity hiring, to candidate experience, to employee benefits, to recruiting KPIs. We also segmented responses by company size in this report, recognizing that recruiting teams in smaller organizations (1-999 FTEs) and larger organizations (1000+ FTEs) may be having different experiences right now. Here’s some of what we found:

Recruiting team—and overall headcount—growth is expected

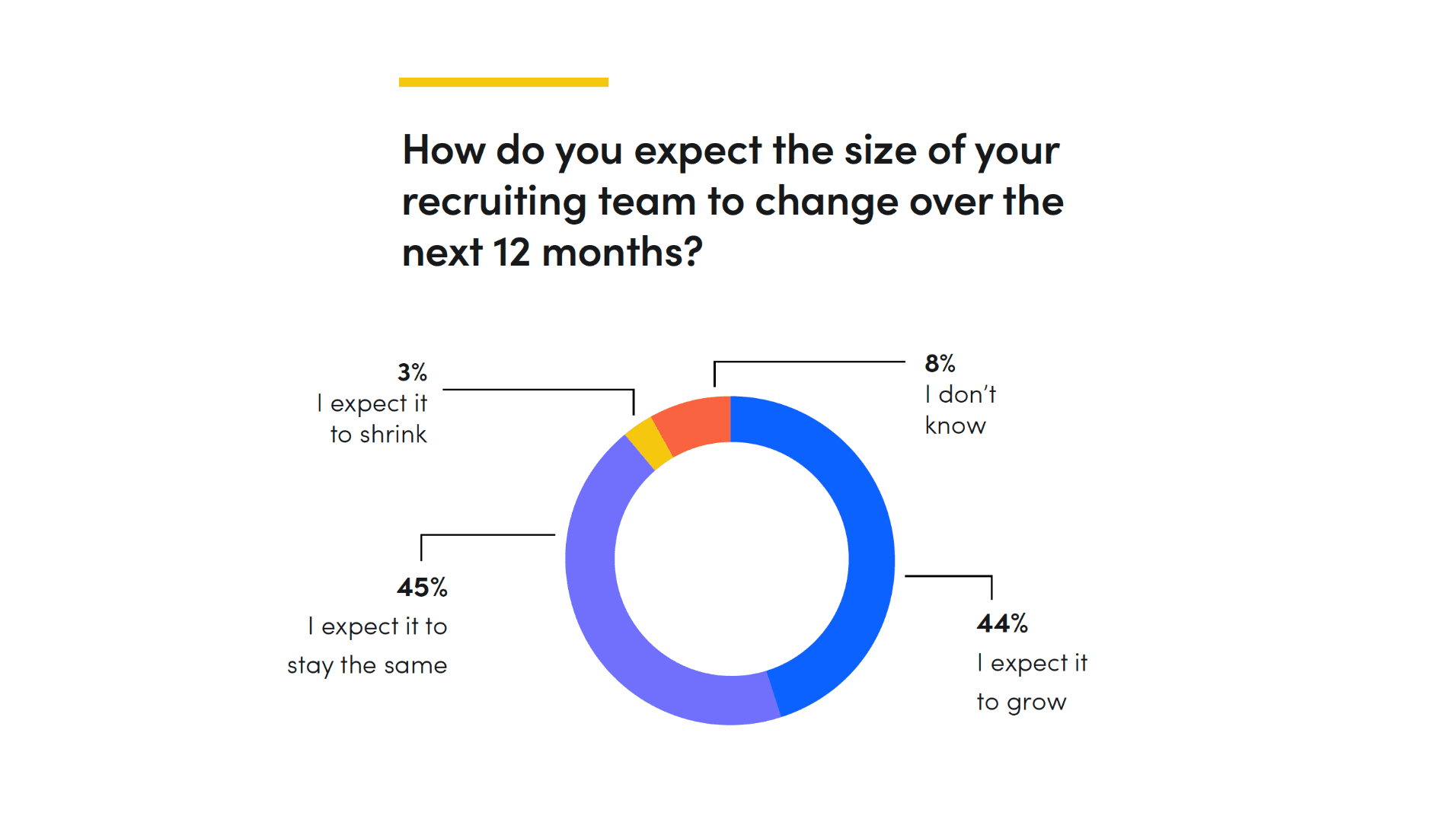

The outlook for 2023 is optimistic: only 3% of manufacturing respondents expect their recruiting teams to shrink this year (TA professionals at larger manufacturing companies are more likely to expect reductions), while nearly 90% say they expect Recruiting will either stay the same size or grow in 2023.

What’s more, 86% of talent acquisition professionals at smaller manufacturing organizations and 77% at larger organizations expect company-wide headcount increases—whether slight or significant—in 2023. (Only 7% and 10%, respectively, expect decreases.) These numbers explain why 44% of all respondents expect recruiting team growth this year.

“What we can now show is: ‘This is how hard our team is working.’ Gem’s data is incredibly impactful when it comes to asking for additional headcount or resources. When the company has metrics that show we’re outgrowing our business, we’re all the more likely to get immediate support.”

- Jaime Schmitt, Talent Attraction Manager for North America @ Celestica

Employee value propositions are the #1 activity talent teams are engaging in in preparation for a market return

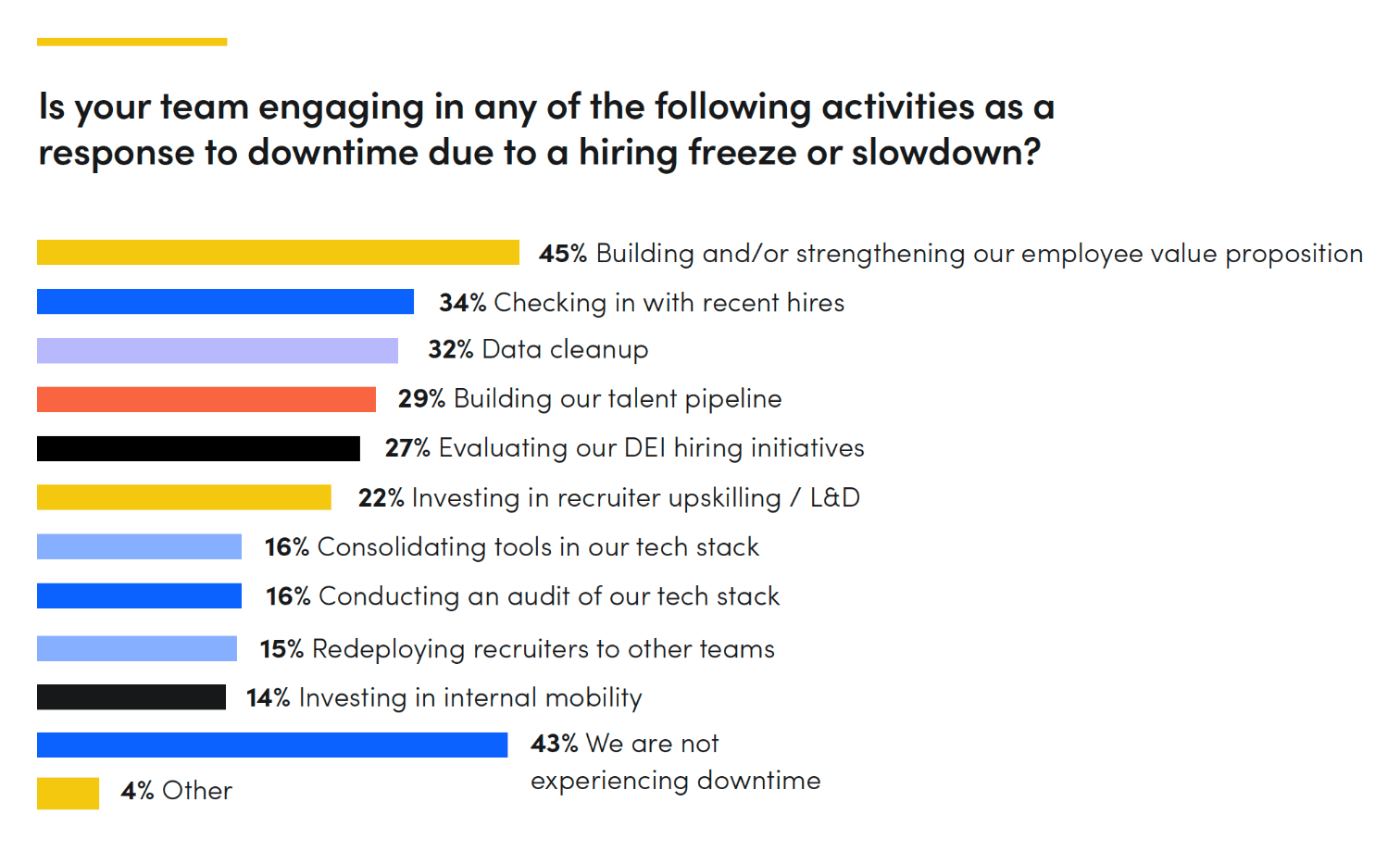

Building and/or strengthening their employee value proposition (EVP) is the #1 activity manufacturing talent teams are engaging in, regardless of company size: 45% of respondents say their teams are spending time on EVPs. Checking in with recent hires and data cleanup are also high on the list of downturn priorities: 34% and 32% of teams respectively say they’re engaging in these activities. (Meanwhile, 43% of manufacturing companies—50% of smaller orgs and 35% of larger orgs—say they’re not experiencing downtime.)

While many manufacturing companies aren’t experiencing downtime, those that are seem to be using this time wisely—which explains why nearly 90% of teams believe they’ll be prepared for a hiring market rebound. (And if you want to know how top talent leaders spend hiring slowdowns, we’ve got a resource for you.)

Meeting diversity goals and initiatives continues to be challenging

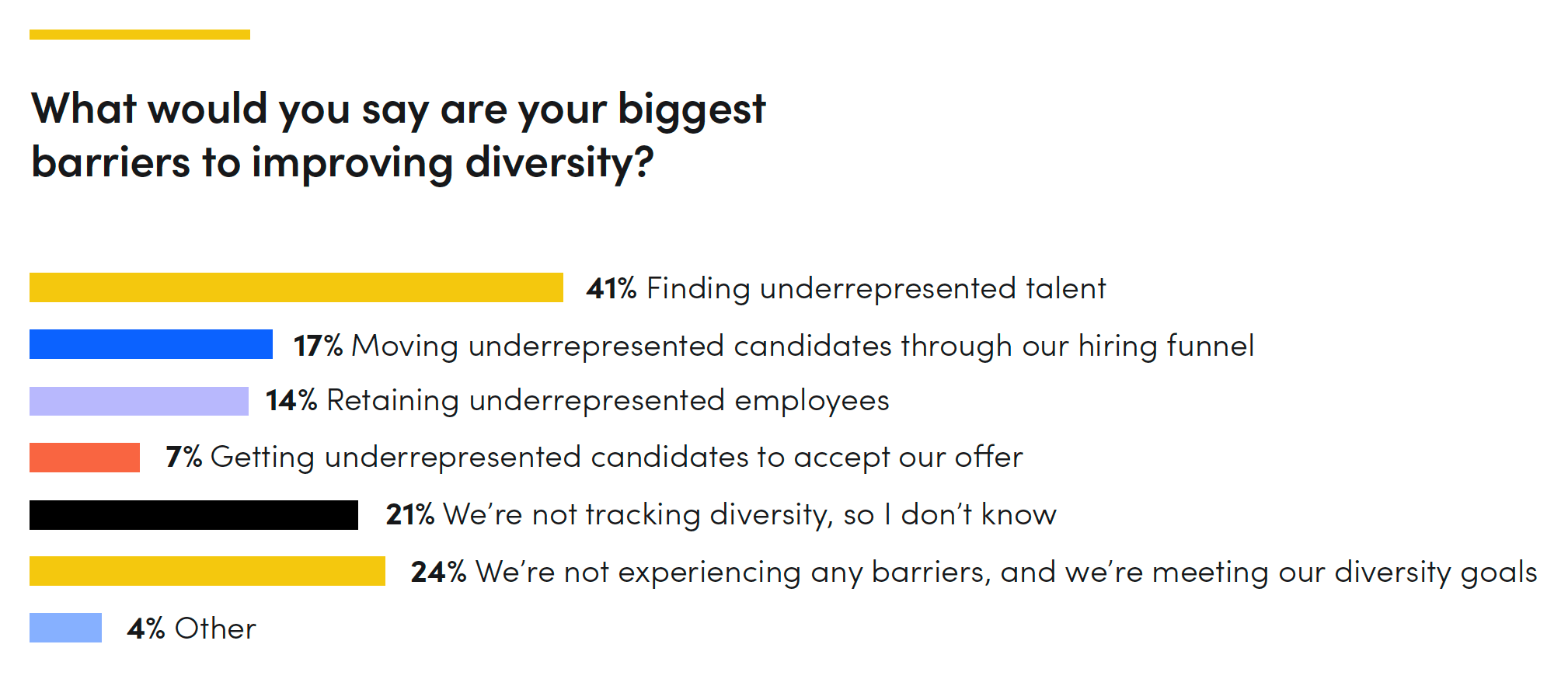

Over half (54%) of smaller manufacturing organizations and over ⅔ (76%) of larger ones say they have formal diversity hiring initiatives or diversity goals in place. 24% of all respondents, regardless of company size, say they’re meeting their goals and not experiencing roadblocks in their diversity initiatives—meaning 76% of teams see at least some struggle in meeting those goals. The biggest barrier for organizations when it comes to diversity is finding underrepresented talent to begin with (41%), followed by moving underrepresented candidates through the hiring funnel (17%), and retaining them once they’re hired (14%).

Retention rate of hire is the #1 data point manufacturing teams are tracking—though source-of-hire is catching up

The top 3 KPIs manufacturing recruiting teams tracked in 2022 were retention rate of hire (61% of teams tracked this), time to hire (58% of teams tracked this), and source of hire (50% of teams tracked this). For the most part, larger organizations were more likely to track most KPIs than smaller orgs were. One exception was offer rejection reasons—smaller organizations were more likely to track this metric.

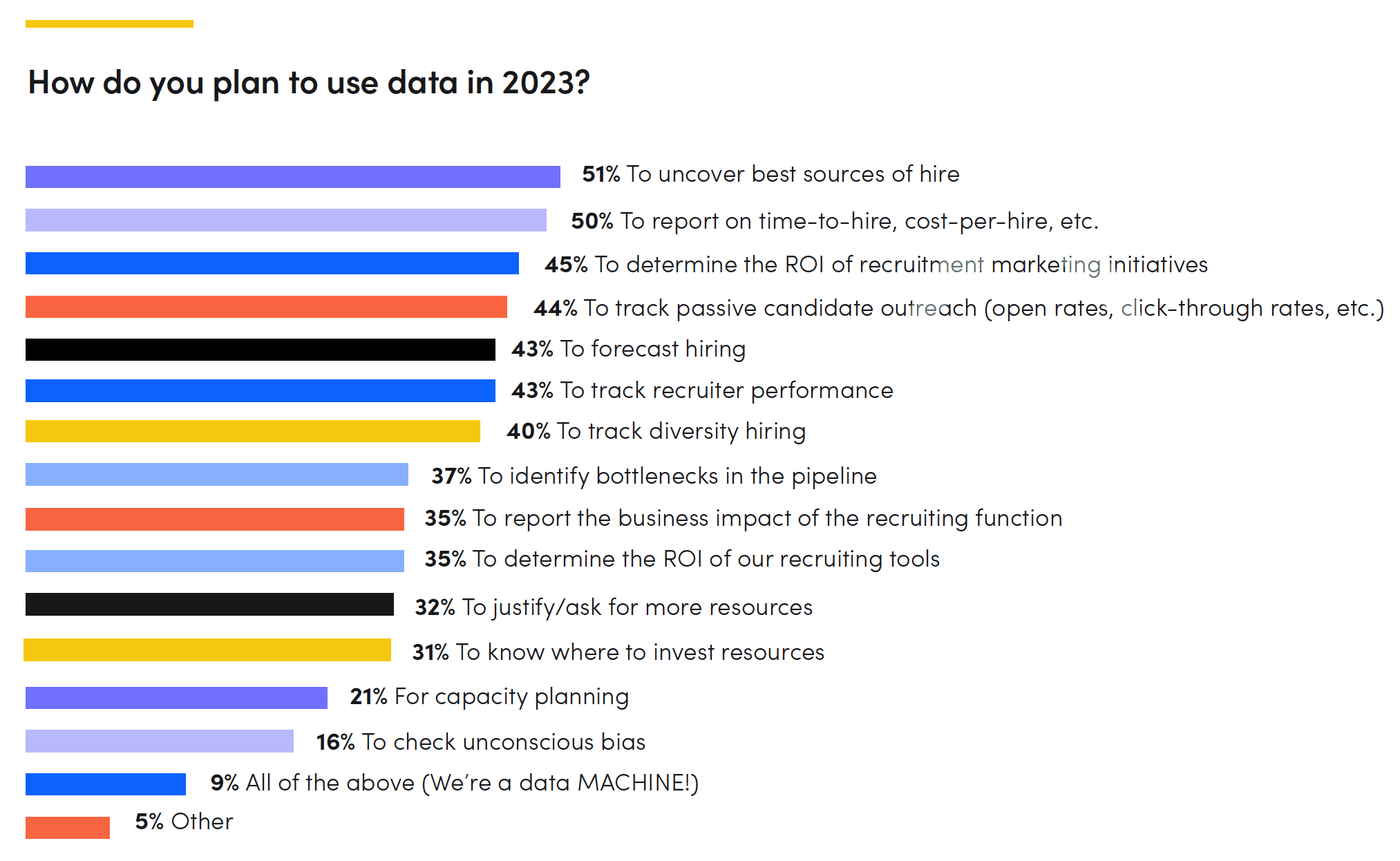

Looking ahead to 2023, the top 3 use cases for data will be similar to teams’ current top KPIs: 51% of manufacturing teams will use data to uncover best sources of hire; 50% will use data to report on time-to-hire and cost-per-hire; and 45% will use data to determine the ROI of their recruitment marketing initiatives.

“We’re a data-driven organization: when we set expectations and have the data to back them up, we typically not only meet those goals, but can also stretch ourselves from a goal-setting perspective. Gem gives us everything from passthrough rates, to best source of hire, to the ability to see how we’re growing the top-of-funnel through outreach sequences. Seeing that data in real-time helps us to benchmark. Now I can start setting expectations with recruiters that historically I haven’t been able to before.”

- Director, Global HR Operations & Talent Management @ a Global Automative Parts Manufacturer

Recruitment marketing is a top priority in 2023

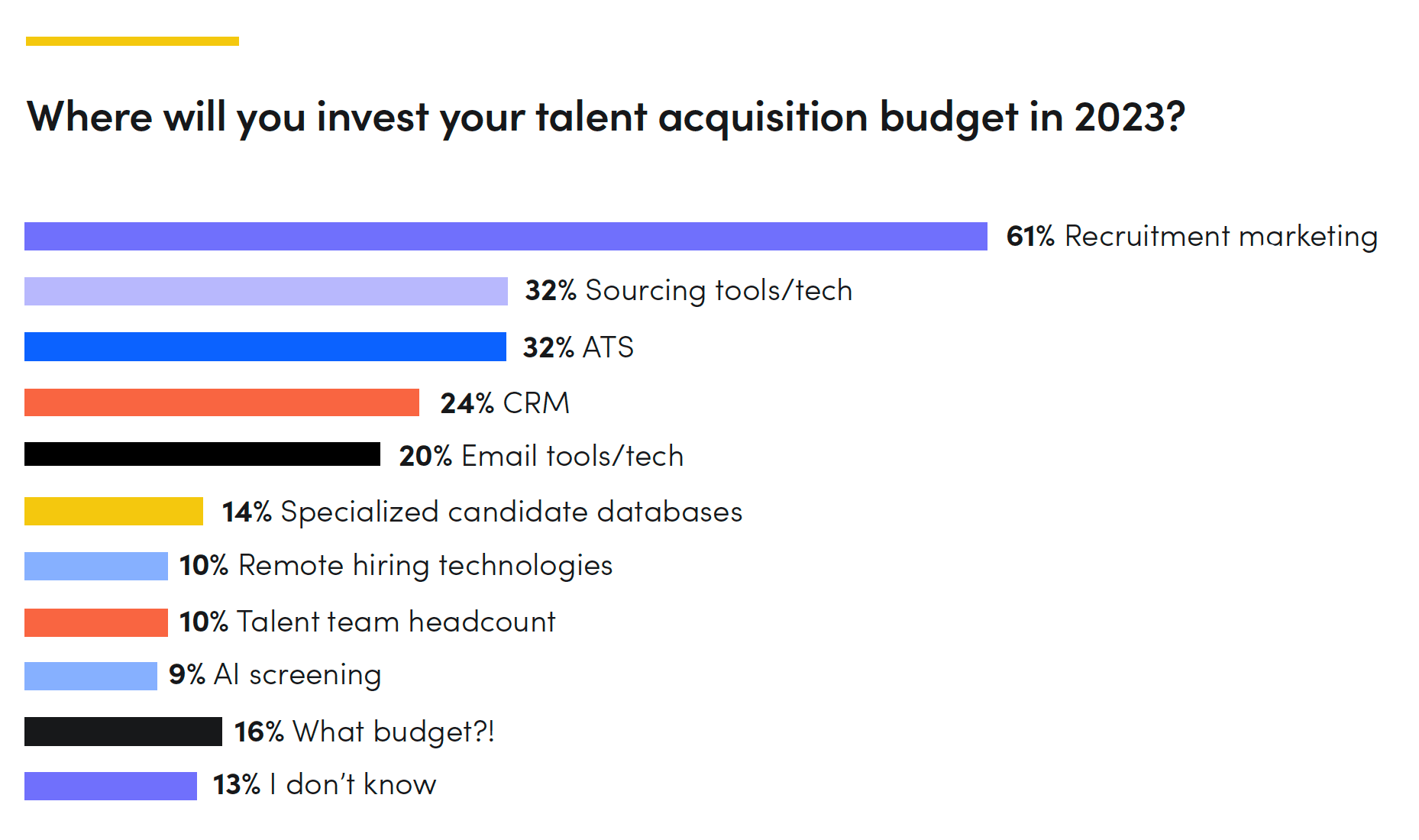

Recruitment marketing tools and tech are, by far, the #1 technology recruiting teams in the manufacturing space will invest budget in this year. (Sourcing tools and tech are #2, applicant tracking systems are #3, and candidate relationship management (CRM) is #4.)

Social media recruitment is the recruitment marketing strategy most used by talent acquisition teams (71%) in manufacturing organizations. Smaller organizations are more likely to host recruiting events (56% v. 42%), while larger ones are more likely to build and maintain talent communities (39% v. 20%) and employment branding campaigns (48% v. 36%).

43% of respondents said social media recruitment has the best ROI of the below strategies. 22% claimed multi-channel touchpoints see the best ROI; 13% said employment branding campaigns do. (And if you’re curious about building a winning recruitment marketing strategy, we’ve also got a resource for you.)

“With Gem, we can quickly measure the success of our events—particularly when it comes to campus recruiting. Its integration with our HRIS system has helped our recruiters see more value in sourcing—Gem’s automation often means instant gratification of return from one’s effort on outreach sequences.”

- Director, Global HR Operations & Talent Management @ a Global Automative Parts Manufacturer

Talent sourcing takes the #1 place in terms of talent team focus

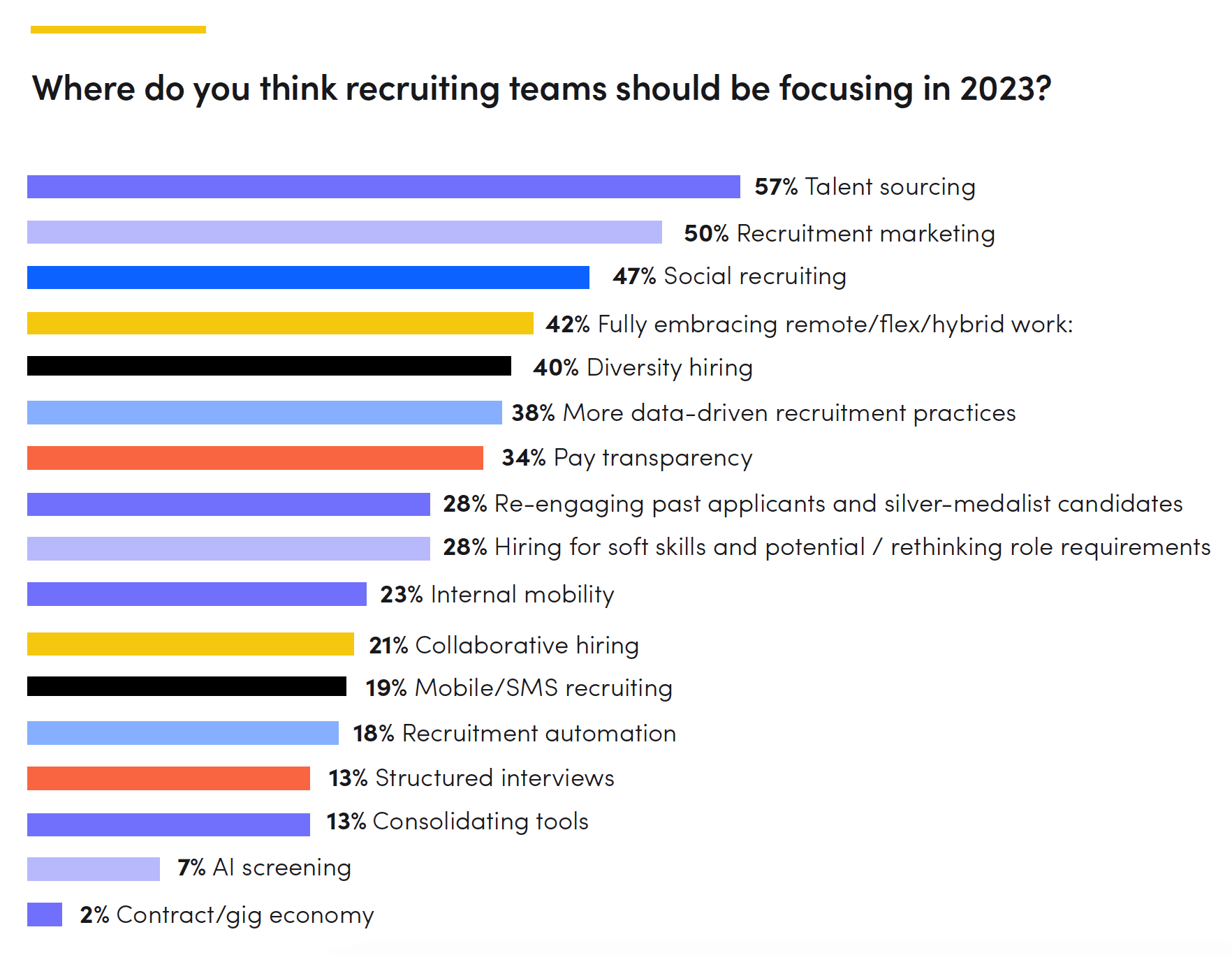

Regardless of company size, “talent sourcing” was the #1 activity respondents said recruiting teams should be focusing on in 2023. Talent professionals at smaller manufacturing organizations also emphasized fully embracing remote/hybrid work, pay transparency, and recruitment marketing; while those at larger manufacturing organizations emphasized recruitment marketing, social recruiting, and diversity hiring.

Finding qualified candidates is 2023’s top challenge for manufacturing recruiting teams

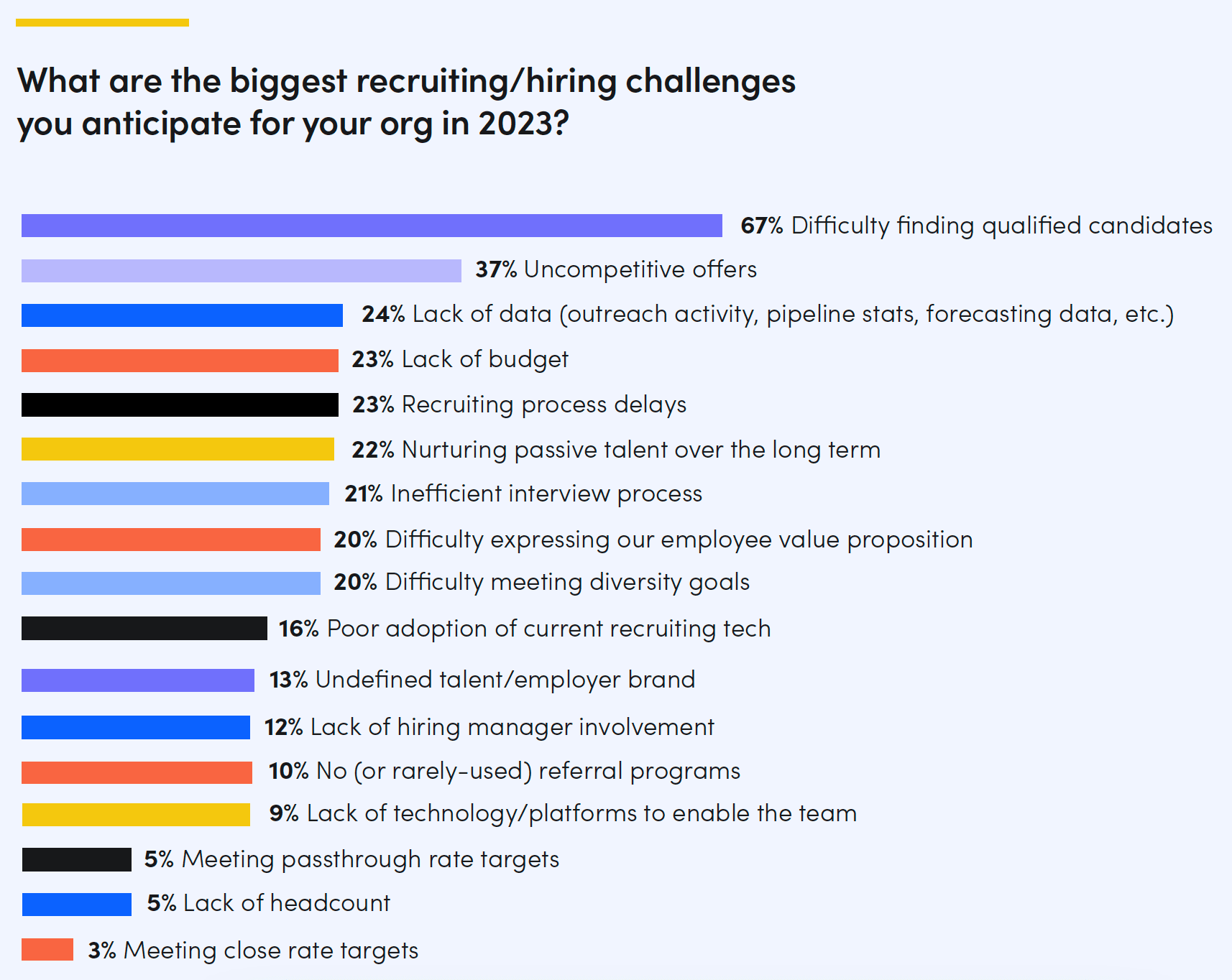

Regardless of company size, the top 2 recruiting and hiring challenges talent acquisition professionals anticipate in 2023 are the same: difficulty finding qualified candidates (67% anticipate this challenge) and uncompetitive offers (37% anticipate this challenge).

There are many more insights in our 2023 recruiting trends in manufacturing report. We hope this resource helps you better understand the broader manufacturing recruiting landscape, assess your company’s place in that landscape, and anticipate what may lie ahead. It’s as important as ever to keep a finger on the pulse of the industry.

Share

Related posts

December 1, 2025

Key takeaways from the 2026 Recruiting Benchmarks Report

November 7, 2025

Flat teams, growing demands: What our 2025 recruiting survey reveals

September 22, 2025

Key insights from our 2025 recruiting trends report

Your resource for all-things recruiting

Looking for the latest data, insights, and best practices? Welcome to the Gem blog. We've got you covered.