Teams that want to be great at hiring can’t just evaluate their process on a candidate-by-candidate basis. Talent Ops leaders can (and should!) be taking a big-picture view if they want to understand their department’s impact on the company. This means having a good way to measure your work and outcomes.

Today’s trend toward data-driven recruiting means most hiring managers have access to plenty of statistics that can help them understand the strengths and weaknesses of their recruiting process. The biggest challenge is often knowing which numbers are most important. Here are essential recruiting metrics to inform your progress toward goals that matter in today’s job market.

Metrics to increase hiring efficiency

An efficient hiring process saves your company money, keeps hiring managers happy, and gives you a better chance of landing that in-demand candidate. Execs who are reevaluating budgets to meet the current moment will value your cost-effective practices.

The following recruiting metrics can help you make the best use of your resources:

1. Cost per hire

Find opportunities to save money by figuring out your cost per hire. This calculation has a lot of inputs; you’ll need to tally up:

Labor costs (interview hours, recruiter salaries)

Sourcing costs (agency fees, advertising and event costs, employee referral bonuses)

Candidate-related costs (background checks, relocation costs)

Overhead (office space, hiring tech)

Some of these figures can’t be calculated per candidate, so it’s best to look at a specific period—say, three or six months. Then divide the total cost by the number of hires you made during that time frame.

You can break the numbers out by cost type, department, source of hire, or other categories to see where your money is going. Look for disproportionate expenses or those that have a bad return on investment to figure out where you can make cuts.

2. Time to hire

Time to hire (TTH) takes away the pre-funnel logistics (job posting, sourcing, etc.) and looks specifically at how long it takes for one candidate to pass through your hiring funnel. Time to hire starts as soon as a candidate is entered into your applicant tracking system (ATS) and ends once they accept an offer. This illustrates the velocity and health of your hiring process aside from all external variables that may impact time to fill.

Naturally, you’ll want your time to hire to be as short as possible (for suitable candidates, of course). A faster time to hire means a smaller likelihood that a good candidate will get a competing offer before you can bring them on, and it improves candidate experience (nobody wants to spend months stuck in a slow hiring process).

Pro tip: When tracking metrics like time to fill and time to hire, keep in mind that different industries, roles, and seniority levels can have drastically different times to hire. For example, the time to fill a senior-level software engineer role will likely be much greater than the time it takes to fill an entry-level sales role.

3. Candidates or interviews per hire

Including too many candidates or interviews in your process wastes everyone’s time. Calculate candidates per hire by dividing the number of people who made it through your initial screening process by the number of people you hired for that role. To look at interviews per hire, add the total number of interviews conducted (e.g., four for Candidate A, two for B, four for C…) and divide it by the number of people you hired for the role.

Reducing these two ratios will help reduce your cost per hire as you’ll lose less productivity to interview hours. But, you don’t want to shoot for a lower number at all costs. Successful hiring teams focus on finding the best candidates and conducting structured interviews that assess all the right skills and traits the first time around.

4. New hire retention rate

Your process isn’t efficient if it doesn’t result in new employees who stick around. Get your new hire retention rate by dividing the number of candidates who stay with your company for at least a year by the number of total hires.

A high retention rate shows you’ve created a data-backed process that assesses candidates objectively, rather than on gut feelings. Teams in this position are using their resources well, which makes a great argument against budget cuts. A low rate means your screening process isn’t working (if new employees are getting fired) or your recruitment marketing isn’t accurate (if they’re resigning).

Metrics to improve candidate experience

A good candidate experience helps you set yourself apart from competitors. The experience you offer during a slowdown can determine whether the best candidates stick around long enough to apply for the right job openings. Use these recruiting metrics to measure how much candidates enjoy getting to know your company:

5. Application completion rates

Give yourself the biggest talent pool possible by increasing your application completion rate. This number can be found by dividing the number of people who finish an application by the number who start it.

Dropoff during the job application process is caused by:

A lengthy application

Asking for too much detailed or sensitive information (like previous salary)

Redundant questions

Tech/compatibility issues

Look at this metric now so you can make it easier for candidates to apply for future job postings with your company.

6. Candidate satisfaction

Candidate feedback is the best tool you have when it comes to tweaking your hiring process so it’s more candidate-friendly. To get an easily quantifiable candidate satisfaction score, administer a Net Promoter Score (NPS) survey to your candidates after they finish the process.

If you’re looking for specific feedback, ask what kept candidates interested and/or caused them to drop out. Ask every candidate for feedback, not just those you hire. People who voluntarily exited your pipeline may tell you how to keep applicants like them engaged in the future.

Top recruiters start building candidate satisfaction before the interview stage. Those that aren’t currently hiring should be building goodwill (and satisfaction) by nurturing their talent pool.

Metrics to help you find and make quality hires

Successful recruiters know where to find the right candidates and how to make job offers that get a “yes!” Teams facing a hiring freeze can take this moment to figure out where they should be focusing their efforts to find tomorrow’s top performers. Here are the recruiting metrics you can use to improve your odds of finding qualified candidates and selling them on your company:

7. Sourcing channel effectiveness

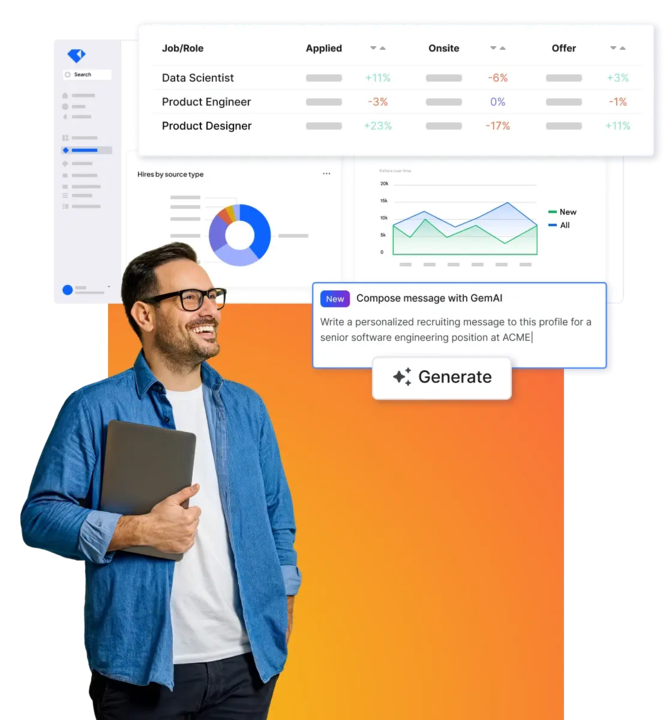

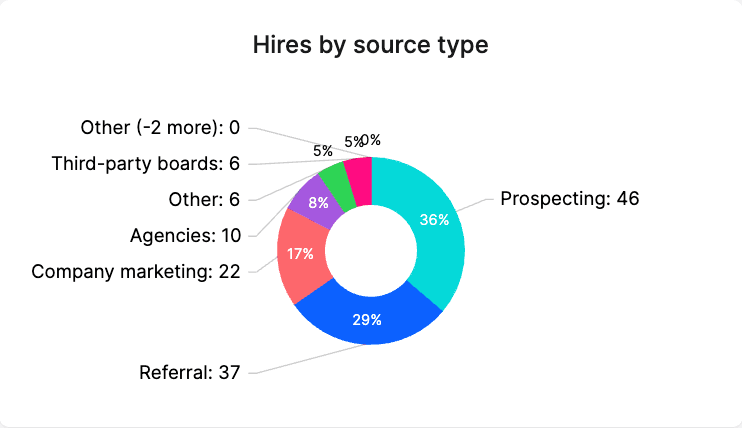

Learn where your best candidates come from, and you’ll know where to focus your resources. You can calculate sourcing channel effectiveness by dividing the number of candidates from a given channel by the number of applicants it brought in. Gem’s Talent Compass filters hires by source automatically so you can easily calculate this metric.

Then compare each recruiting channel’s effectiveness. It can be tempting to double-down on platforms that generate the highest number of applications if you don’t have the budget to support every channel. But you’ll get better outcomes if you stick with the platforms that give you quality candidates—even if you get fewer applicants overall.

8. Offer acceptance rate

The effort you put into wooing a candidate only pays off if they say yes to your offer. Determine your offer acceptance rate by dividing the number of offers candidates accept by the total number you make.

It may be hard to improve your acceptance rate if your company isn’t in a place to offer competitive compensation and perks right now. Do your part by ensuring your process builds proper expectations, so candidates can self-select out if your company can’t meet their needs. For a more in-depth look at offer acceptance rate, check out our Ultimate Hiring Dashboard article.

9. Quality of hire

Look at whether quality candidates turn into quality employees to make sure your hiring process is focused on the right traits. There are multiple measures you can use to establish quality of hire:

Performance reviews

Employee engagement scores

Hiring manager satisfaction

Time to productivity

Track at least one of these metrics through a new hire’s first year and compare their score to top performers from the same department.

Revisit your notes on candidates who haven’t met expectations since joining your company. It takes time to pinpoint the traits or skills your screening process misjudged or missed—but that means this is a good task to undertake during a hiring slowdown.

Metrics to diversify your pipeline

Having a diverse pipeline gives you access to more top talent. Recruiting teams that aren’t currently hiring should be building relationships with a diverse array of candidates, so you’ll have a full talent pool when hiring starts up again.

Attracting underrepresented candidates requires active and intentional efforts. Use the following key recruiting metrics to hold team members accountable for doing their part:

10. Diversity of candidates

A non-diverse pipeline lacks the depth necessary to find the best candidate for every position. Determine whether you’re reaching a diverse audience by gathering EEOC data or demographic information like gender and race/ethnicity, which is a part of candidates’ online profiles.

Compare numbers to see which demographics aren’t even applying. Then check your job descriptions and marketing materials for things like gendered language and unnecessary requirements that can discourage candidates from underrepresented groups from putting themselves forward. Work on revisions and approvals now, so you’re ready to ship inclusive materials when the next job requisition comes through.

11. Passthrough (conversion) rates

Look for inequities within your recruitment funnel by measuring passthrough rates by candidate demographic. It’s easy to calculate the passthrough rate: just divide the number of candidates who advance from a stage by the number of candidates who entered that stage. Gem lets you view passthrough rates by gender and race/ethnicity, so you can see where marginalized candidates are exiting your pipeline.

Focus your energy on improving stages where certain demographics disproportionately exit. Our diversity recruiting toolkit can help you build an inclusive brand and recruiting process that’s ready to scale. You’ll be in a better place to reach all candidates next time you start hiring.

How recruiting metrics help you make a difference

Individual metrics that represent one date or time period are useful when compared against industry benchmarks. But the best talent acquisition teams use data to prepare for the future. The first step is tracking hiring metrics over time to see how your department (and the hiring world) is changing.

Advocate for your department and team by writing up your findings in strong reports that address the concerns of leadership, hiring managers, and other stakeholders. It’s hard to make moves when budgets are tight and scrutiny is high. Having data to back your arguments may convince the skeptical that you’re still adding value—even if the payoff will come in the future.

Finally, don’t be afraid to pivot if your recruitment strategy isn’t working. Data is a guideline, not a guarantee. Teach your team to look at data critically and make adjustments based on what they see. This practice will set them up to thrive in any job market.

Share

Related posts

November 7, 2025

Flat teams, growing demands: What our 2025 recruiting survey reveals

October 24, 2025

How to build an effective recruiting capacity plan

August 26, 2025

Why Gem's Workday ATS integration is different and better

Your resource for all-things recruiting

Looking for the latest data, insights, and best practices? Welcome to the Gem blog. We've got you covered.