If there’s an ongoing, mission-critical question being asked on every talent acquisition (TA) team, it’s this: Are we currently on track to hit our hiring goals this quarter? Every member of your team is asking themselves this daily. Yet as a talent leader, your version of this question likely looks a bit different: How do our headcount goals compare to the current capacity of our recruiting team? It’s one thing to ask if you’re meeting your goals; it’s another to ask if you’re even equipped to meet them. Thats where capacity planning comes in.

Capacity planning is the means through which you ensure you have enough resources on your TA team to meet the hiring needs of the business. It ensures you don’t say ‘yes’ to every new headcount request that comes your way without knowing, for certain, you have the resources to take it on.

The best capacity planning model looks backwards at historical data to accurately forecast hiring needs and what your org can do in the (imminent) future. Know that there’s no one way to build a capacity plan; and your model will be more-or-less complex depending on the size of your org, or whether this is your first time modeling or you’re iterating on a model that’s already in place. Below, we walk you through building a model that uses historical hiring data to determine if you’re properly resourced to meet headcount needs, recalibrate with functional leaders, and prioritize new resources.

1. Get involved in the headcount-planning process

Ideally you’ll be a part of headcount conversations as they’re happening. If you’re not yet, start building relationships with Finance and with functional leaders (i.e. Head of Sales or Head of Eng if you’re a smaller org, Directors and VPs if you’re larger). You’ll know that you’re viewed as a strategic member of the “TA—Finance—functional leaders” trifecta when you’re meeting with them every other day during the headcount planning cycle.

Your goal in these conversations will be to help other stakeholders understand what your team needs in order to support their respective agendas. If headcount negotiations happen without you, you run the risk of Finance and leadership assuming that whatever headcount targets they land on, you’re capable of hitting. So think of your presence in these conversations as a form of checks-and-balances—as wellas a desire to understand their goals.

2. Separate out roles, and consider assigning weights to them

You know as well as we do that you can’t simply take the final headcount Finance gives you and assign each of your recruiters the same number of reqs: ICs working more high-volume roles will look like they’re killing it, while those who get harder-to-fill roles will experience drops in morale. Some reqs are simply more demanding than others. So treat them as such.

If this is your first time building out a capacity model for staffing, start simple. In fact, most organizations we work with at Gem keep this step pretty high-level. Maybe you separate tech roles and non-tech roles, since tech roles are generally twice as hard to fill. Maybe you separate out executive roles and university hires, since they’re more and less difficult to hire for, respectively, than your typical ICs or entry-level manager roles. Solve for what remains.

A more complex way to ensure an even workload is to assign each headcount a weight by difficulty. Beyond the difficulty of the particular role, you might consider these criteria:

Source-of-hire. There’s a difference in passthrough rates between active and passive talent, for example. Data will tell you how much time (and how many resources) it takes to hire each.

How new the role is to the org. The recruiter and hiring manager may need more (or fewer) meetings than usual to align.

Sourcer/recruiter experience. If a recruiter is ramping up, for example, they may only be expected to hire at 50% capacity.

Location. You might take location-based conversion rates into account if you’re hiring in a handful (or more) of geos.

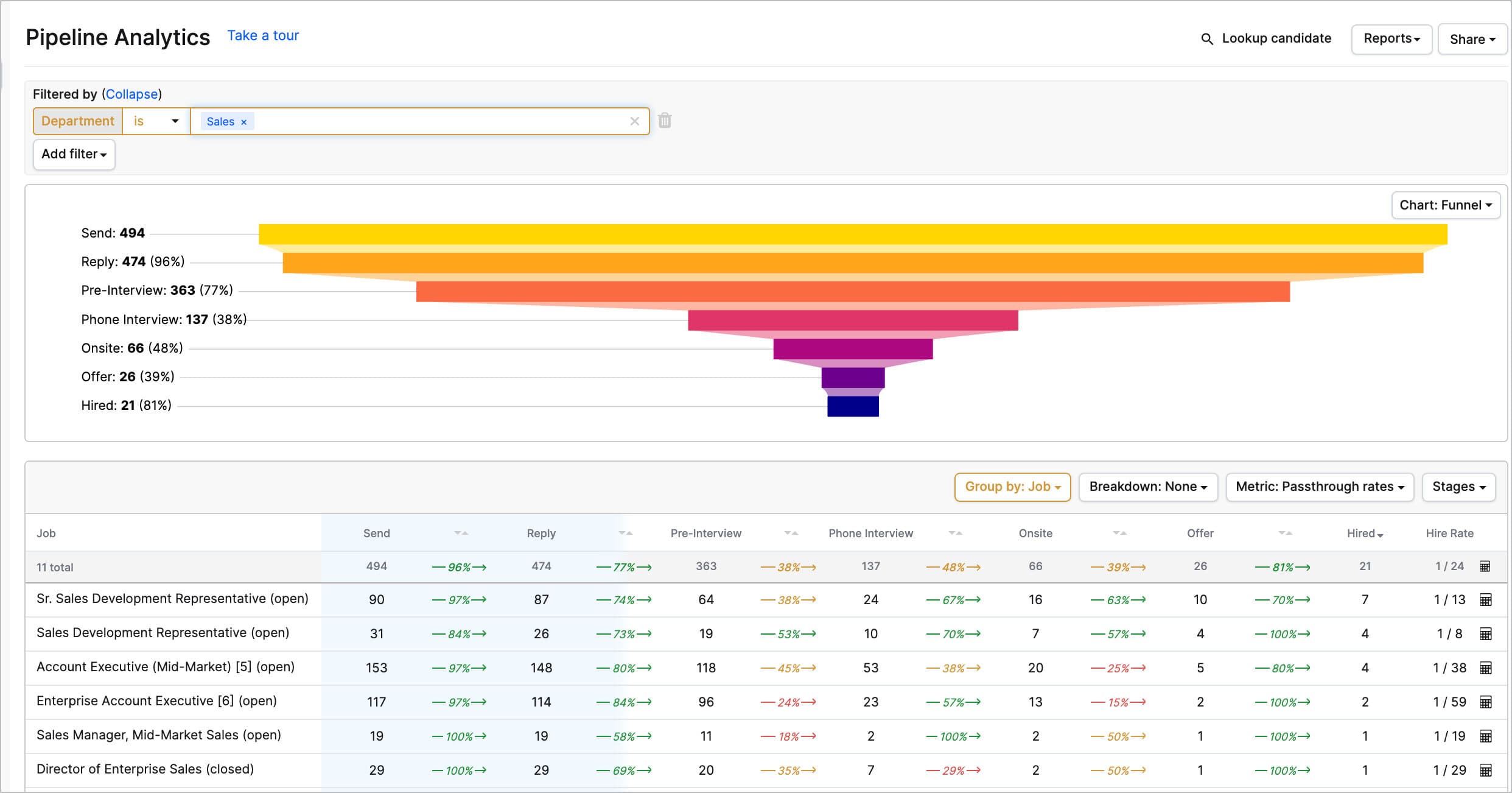

Bottlenecks in specific pipelines. Solutions that track historical data will show you where the bottlenecks are in certain funnel stages for certain roles. You might take those time-to-fill differences into consideration.

We can’t stress enough the importance of building a capacity model that derives the necessary insights without being overly-complex. There’s a considerable difference between asking “How many recruiters do I need to meet our hiring targets this year?” and “How many hires can I expect from each recruiter while also considering the level of difficulty of each role?” If this is your first go-round at capacity planning, consider starting with that first question.

3. Determine historical productivity

You can’t predict future performance without knowing historical productivity metrics. If recruiting is a newer function in your org and you don’t have historical data to work with, use industry benchmarks, or ask your peers at similar-stage companies what numbers they’ve used to model. We recommend collecting two years’ worth of data to account for, and smooth out, seasonal trends. Of course, remove any anomalies—if there was a hiring freeze one quarter, extract that quarter’s data from your calculations.

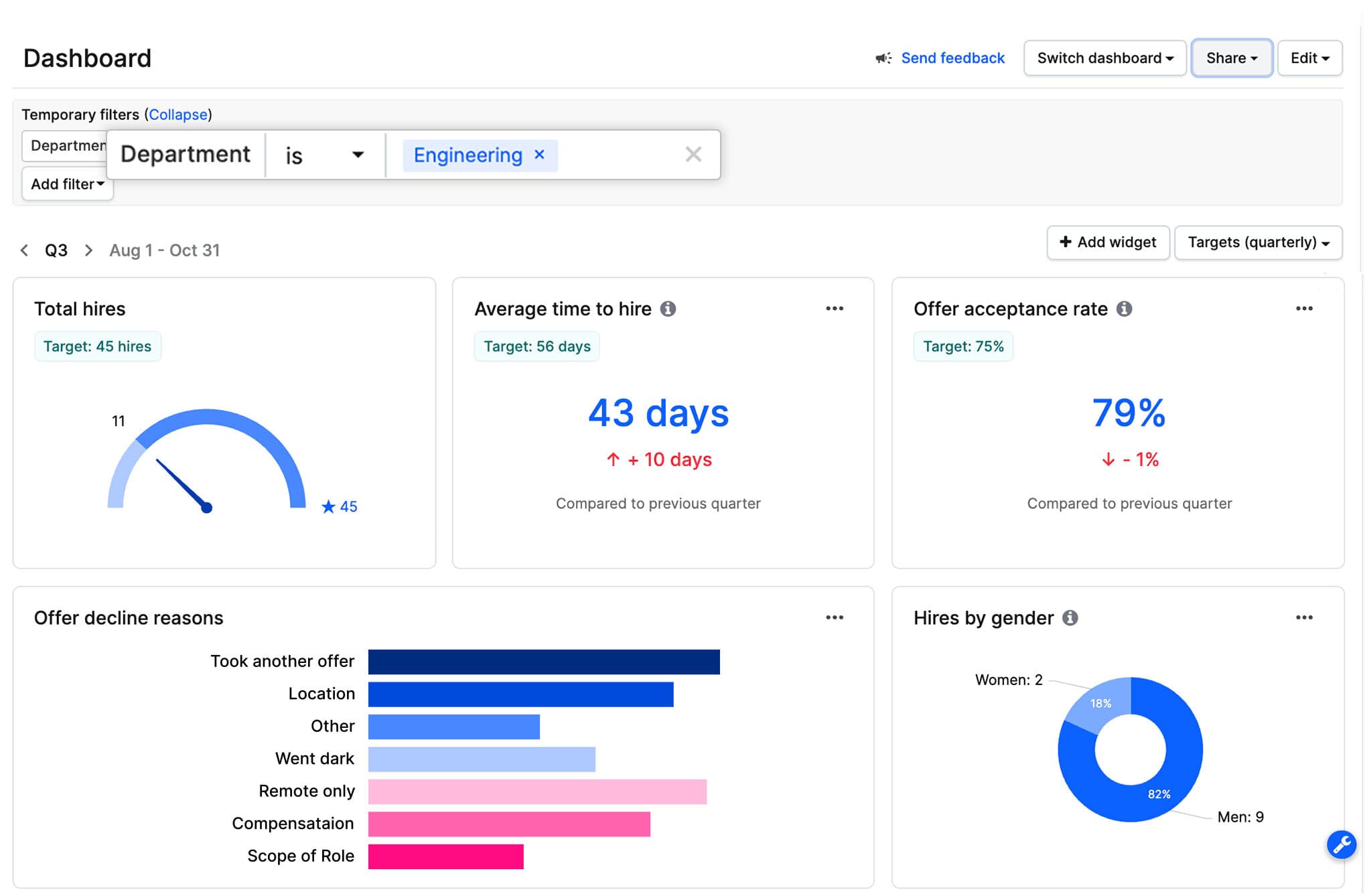

If you use a sourcing/recruiting solution (like Gem!) that collects that data for you in a centralized source-of-truth, this step will be simple: pull up the number of hires made per department over the last two years, and divide those numbers by the number of full-time recruiters who supported each department.

If you see, for example, that your average number of hires per quarter last year was 8.33 in Engineering, and you know that there were only two dedicated recruiters for this department, you know you can expect around 4 hires per recruiter, per quarter in Eng. This is your productivity-per-resource (PPR). Did your technical recruiting team also have a sourcer? A recruiting coordinator? It doesn’t have to get much more complicated than this. You know that a quartet of 2 recruiters, 1 sourcer, and 1 RC equaled 4 hires per quarter. That’s a ratio you can work with.

If you don’t have a solution like Gem in place, reach out to your ICs (or have your talent leaders reach out to them) and find out how much time they spent supporting their various business units. Ask how many offers-extended your sourcers saw and how many offers-accepted your recruiters saw. If your recruiters work across departments, ask what percentage of their time they spent on searches and hires for each unit.

All these data points will get you to the same place: how much activity occurred over the last two years to make the number of hires you made per department, per quarter? Divide that by the number of full-time recruiters who supported each department to calculate PPR.

4. Use historical productivity to forecast future performance

So how do you calculate recruiter capacity? If a recruiter hired, on average, 4 engineers per quarter last year, they’ll likely be able to hit similar numbers this year. So once you’ve determined historical PPR, multiply that number by the number of recruiters on your team to forecast how many reqs your existing team can expect to fill per quarter in the coming year.

Of course, you’ll have recruiters who are more senior and others who are more junior. But if you’re building a balanced team, you’re working on the assumption that everything will average out. If your PPR is 10, one recruiter might make 8 hires while another makes 12. But you’re still averaging 10 hires per recruiter, as your model predicted.

When it comes to other roles, factor these in as you need. Perhaps you already have a recruiter-to-recruiting-coordinator ratio in place; keep that ratio for as long as nobody feels overextended. When it comes to sourcing support, you’ll decide how much you want sourcing to contribute to your total number of offers extended. In part this may depend on the volume (and quality) of inbound you receive; in part it may depend on your best source-of-hire. Do you need to build pipeline in Q1 to prepare for a hiring spree in Q3? This might be a reason to invest in more sourcers—but perhaps temporarily, through an RPO. And so on.

5. Factor in attrition and a buffer

There's at least one adjustment that you’ll want to make to your model once you’ve determined your PPR. The first is attrition, which is a number you’ll get from HR or from your FP&A team. If your goal is to end the year with 80 engineers and your current headcount is 50, that means your gross target is 30 engineers. But if your company’s average attrition rate is 15% and you don’t model that in, you’ll be short the 7-8 engineers who left your org in the meantime. So bake 38 hires into your capacity plan in order to net out on your end-of-year target of 80.

The other thing to consider adding to your capacity model is a buffer for unforeseen circumstances. (If you’re modeling using your org’s historical data, there’s already a buffer of sorts in there, since your team probably did experience unforeseen circumstances at some point over the last two years.) Sick leave, parental leave, termination—all of these things cause you to lose resources for periods of time. Building in a buffer ensures you’re not in a situation in which everything has to go perfectly for the team to hit its hiring goals.

6. Check in with your leaders: Are they comfortable with your numbers?

Of course, if your org is small enough that you are the leader, consider this step done. But if you have a talent leadership team, you’ll want confirmation from your leaders that their respective teams are capable of doing what they’ve historically done. Do they feel comfortable using these productivity assumptions? Is their team currently equipped to deliver x hires per recruiter?

Maybe your eng recruiting leader reminds you that she’s hiring in Boise for the first time, and the org doesn't have any pipeline in Boise. So she can only promise 80 hires next quarter rather than 100… but she can commit to 100 the following quarter, because the team will have built pipeline by then. And so on. Get that qualitative feedback from your leaders. Make adjustments to your capacity model where they propose them.

7. Calibrate the gaps

By the end of step 6, you have your capacity plan. With the data now in one place, you can see what the gaps are between your team’s current capacity and the business’ hiring goals. There are a number of ways to close those gaps:

Increase your hiring capacity, whether that means growing the team, augmenting with agencies or RPOs, or plugging in contingent workers for the short-term.

Lower hiring goals—for instance, cutting any nice-to-haves from the headcount plan.

Draw out hiring timelines. Does that volume of hires really need to be made within the timeframe you’ve been given?

Consider tooling. Outreach automation, scheduling software, and assessment software are tech-stack additions that will increase efficiency, shorten time-to-hire, and give your team time back to make more hires.

Optimize your funnel for speed. Maybe you skip a stage to move candidates through the funnel more quickly. Maybe you incorporate batch days, since a few focused days of interviewing is more efficient than months of drawn-out process.

And so on. Get creative. Collaborate with leadership to determine the best strategy for your business.

Then rinse-and-repeat regularly: while you may only iterate wholly on your model once a year, you should perform a monthly re-forecast to ensure your initial inputs were accurate. Adjust where you need to. And be patient with yourself. Capacity planning isn’t an exact science. But it will certainly put you in a position to be a much stronger partner to your business.

And if you want to take your capacity planning game to the next level? You're in luck... because we've got a more complete guide to building a capacity model here.

Share

Related posts

November 7, 2025

Flat teams, growing demands: What our 2025 recruiting survey reveals

October 24, 2025

How to build an effective recruiting capacity plan

August 26, 2025

Why Gem's Workday ATS integration is different and better

Your resource for all-things recruiting

Looking for the latest data, insights, and best practices? Welcome to the Gem blog. We've got you covered.