As a Finance leader, there are certain KPIs you’re thinking about regularly: the ratio of quota to OTE of your sales reps, sales productivity ratios, cost per lead for Marketing, ARR supported per CSM. And there are plenty of industry benchmarks out there to measure your company against for these things. But recruiting organizations tend to fly under Finance leaders’ radars. CFOs are sometimes unfamiliar with recruiting-specific benchmarks. They spend relatively little time thinking about recruiting KPIs, and they may not be paying close attention to the ROI of their organization’s recruiting software.

This is likely because, while Sales and Marketing are intrinsic to revenue, Recruiting is still generally lumped in with the HR or People team and viewed as a cost center. Finance leaders don’t measure their Head of People in terms of productivity, and they generally plan People team growth in terms of basic industry ratios: one HR person for every x employees. They may not be used to thinking about their recruiters in quantitative ways, either. Instead, they turn over a sum of money to the recruiting org—likely after doing some rough math with an input of how many people the company plans to hire this year—and watch the total amount of spend over time to ensure it’s not increasing too quickly relative to the size of company spend. (Perhaps this scenario sounds familiar to you.)

What Finance leaders are typically not doing is building a recruiting model with granular productivity assumptions and debugging recruiter productivity. And that’s precisely because they’re not thinking about Recruiting in terms of productivity or efficiency in the first place—something that, at Gem, we’d like to change. They’re often not bringing industry benchmarks to their talent leaders and asking: “How is it that you have a recruiting team of 10 and you can only hire 50 people, when the industry standard suggests that each recruiter should be able to hire 10 people a year?”

Despite Recruiting flying under Finance’s radar, we know that the fastest way to a CFO’s heart is a concrete sense of ROI. You think in terms of dollars; and being able to tie your recruiting software back to faster time to hire, lower cost per hire, or more ARR per employee is essential if you’re going to consider spending on it. For every dollar you’re investing, what’s the benefit you’ll see both in the short-term, and over time, that will allow you to invest even further in your company’s growth?

Here are some ways Gem gives back a terrific return on investment:

Increase operational efficiency, and decrease recruiting team headcount

Because Gem’s top-of-funnel automation makes recruiters 20% more efficient, each of your recruiters can take on more reqs than they’re able to now. A greater productivity per resource (PPR) means you’ll need fewer recruiters on the team to bring on the same number of hires for the company—which ultimately means reduced current or future employee costs. As an example, let’s say you’ve got a team of 14 recruiters salaried at $100k/year or $48.08/hour. With a team that size—and a time savings of 144 hours per recruiter per year using Gem—you’ll see an annual savings of $96,929. That’s a full headcount you won’t have to account for when planning for next year’s recruiting team capacity.

“The great benefit of Gem is it’s essentially a multiplier. Once you have the ability to sequence the folks you’re reaching out to—to have a second, third, fourth email auto-send—you’re increasing productivity per resource considerably. Now one sourcer is doing 4x the reachouts. So right there, just at the top of the funnel, you have this enormous ROI.”

- Jay Patel, Director of Talent Acquisition @ DoorDash (formerly @ Lyft)

Cut down on contractor/agency spend

Beyond salaried employees, Gem also eliminates some of the one-time—and recurring—costs associated with external agencies or embedded recruiters. Agencies are typically a last resort for the roles that are notoriously hard to fill with your internal team. And they’re costly: agency fees are typically 25-30% of first-year compensation, paid out in a lump sum. At 25%, you’ll pay an agency $45k to fill a role with a salary of $180k.

As a Finance leader, you know that lump sum is hard to watch go. Teams pay for augmented capacity at a premium, and it’s a solution that simply won’t scale as the number of open reqs you have increases.

Because Gem allows the average recruiter to be more productive—our customers see 5x faster sourcing, 2x response rates, and 5x higher passthrough rates with our talent engagement platform—they can typically make a handful of hires more every year than they would without Gem. The ability to get more hires out of your internal team can be game-changing from an agency spend perspective: if those are roles that would otherwise have to be filled by agencies, that’s an immediate cost-savings of $100-$200k… or more.

“We eliminated agencies with the onboarding of our sourcing team using Gem, which saved us about $300k in the first half of last year.”

- Angela Miller, Head of Recruiting @ Instabase (formerly @ Pure Storage)

“In the healthcare world, agencies take 15-20%; though I understand that percentage is much higher in other industries. You average that out, and I easily saved over $125,000 in my first year on agency fees for the roles I filled with Gem sequences. Gem has paid for itself well over 9x—a more-than 1000% ROI, just in the roles that I recruit for as a working manager.”

- Blake Thiess, Head of Sourcing & Senior Headhunter @ AdAstra (formerly @ Prestige Care)

Identify interview inefficiencies and reduce interviewer time

Time is money, and your employees’ time is expensive. This is especially true for leadership roles or roles such as engineering, where time spent interviewing means time not spent writing code—and thus a slower product roadmap and less product to sell. Granted, productivity loss is easier to quantify when it’s tied to revenue-generating roles; but anytime you can realize x hours of time saved per employee, you can do the math based on average comp for that role, translating hours saved into dollars. (You’re a Finance leader; we know these calculations are second nature to you.)

Gem’s Talent Compass helps recruiting teams identify pockets of inefficiencies and lost productivity in their hiring process to ensure employees are spending less time getting stuck in unproductive interviews, and more time carrying out their job functions—giving those x hours back to them. Is one department seeing sub-par passthrough rates from onsite to offer, suggesting team members are spending ultimately-unproductive time in interviews? Now the hiring team knows precisely the stage of the funnel it needs to optimize for efficiency.

Passthrough rate data also allows for best (read: most efficient) practices to be shared across departments and geos, redundant stages of the funnel to be omitted for greater efficiency, and more. All of this means employee time—and, ultimately, cash—savings.

“One of the reports we ran in Gem was around how much of the team’s time we were using to review candidates. Let’s say it was 30 hours of time to hire a single person. We then set a goal of 20 hours per hire. It’s important to be able to quantify the ROI in terms that matter to a CFO. They care about the time their engineers spend on things other than building.”

- Jonathan Tamblyn, Chief People Officer @ Skolem (formerly @ Gemini)

“Gem’s passthrough data allows us insights into some really important questions: Do certain roles have healthier funnels than others? If so, are there best practices we can apply from one funnel to the next?”

- Kyle Ijichi, Senior Technical Recruiter @ Carta

Identify inefficient spend on candidate sources—while your team amasses a central goldmine of talent data

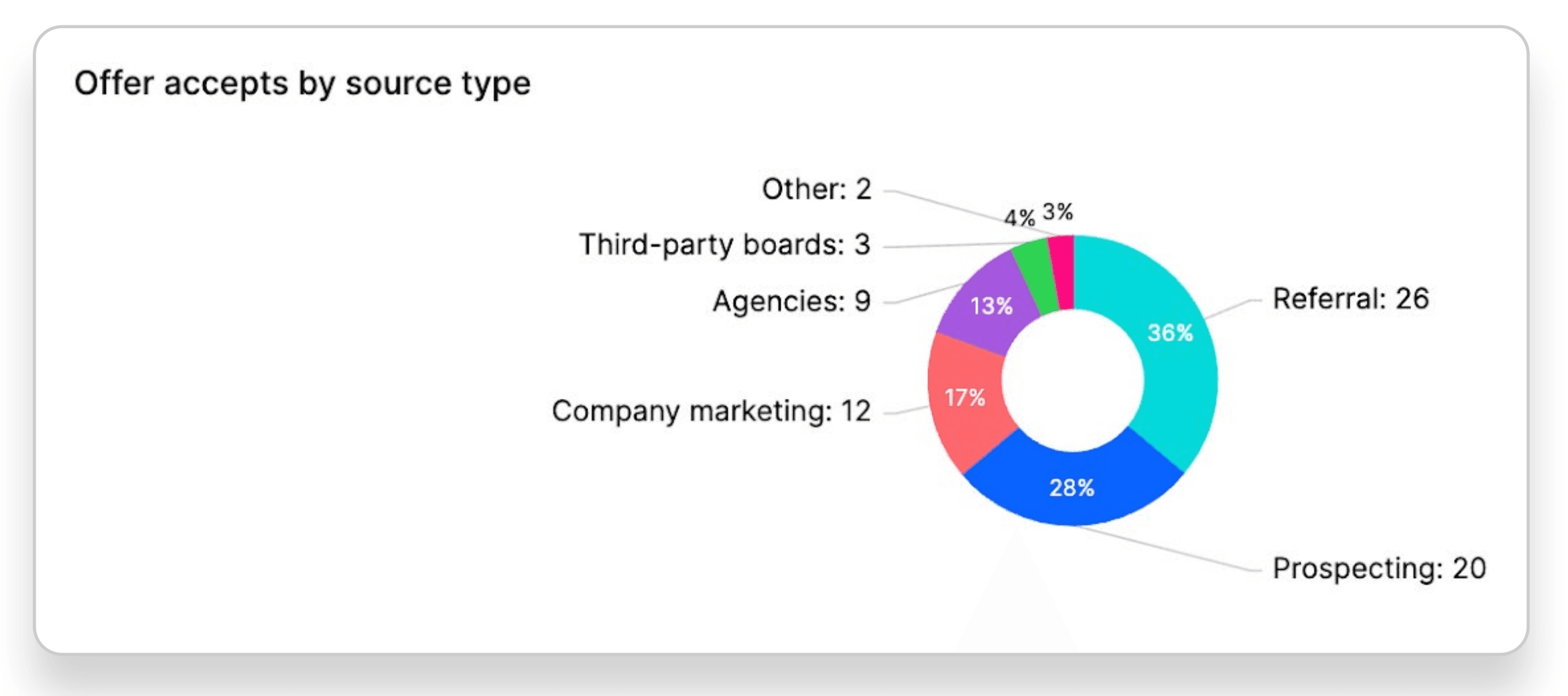

Beyond meaningfully increasing productivity, Talent Compass helps recruiting teams identify candidate sources that aren’t delivering ROI. Most recruiting organizations have a wide array of places they source candidates from: recruiting events, specialized job pools, LinkedIn job ads, diversity-focused platforms like SeekOut, outbound AI platforms like hireEZ, specialized vendors like Alpha for engineering talent, and so on. But which of those solutions you’re paying for is ultimately getting you the talent you need? Where are the majority of your offer-accepts really coming from?

Because Gem details candidate source—showing teams clearly what’s working and what’s not—Finance leaders can push Recruiting to reduce or cut spend on resources that aren’t seeing ROI at the very top of the funnel.

What’s more, with Gem’s forthcoming Source Spend Calculator, teams can go one layer deeper, tracking cost-per-application and cost-per-hire from each of their sourcing channels. They can leverage these insights alongside their CFOs to make even better decisions about the channels they invest in, driving both efficiency and cost savings by removing those with low conversion rates and high cost per application/hire.

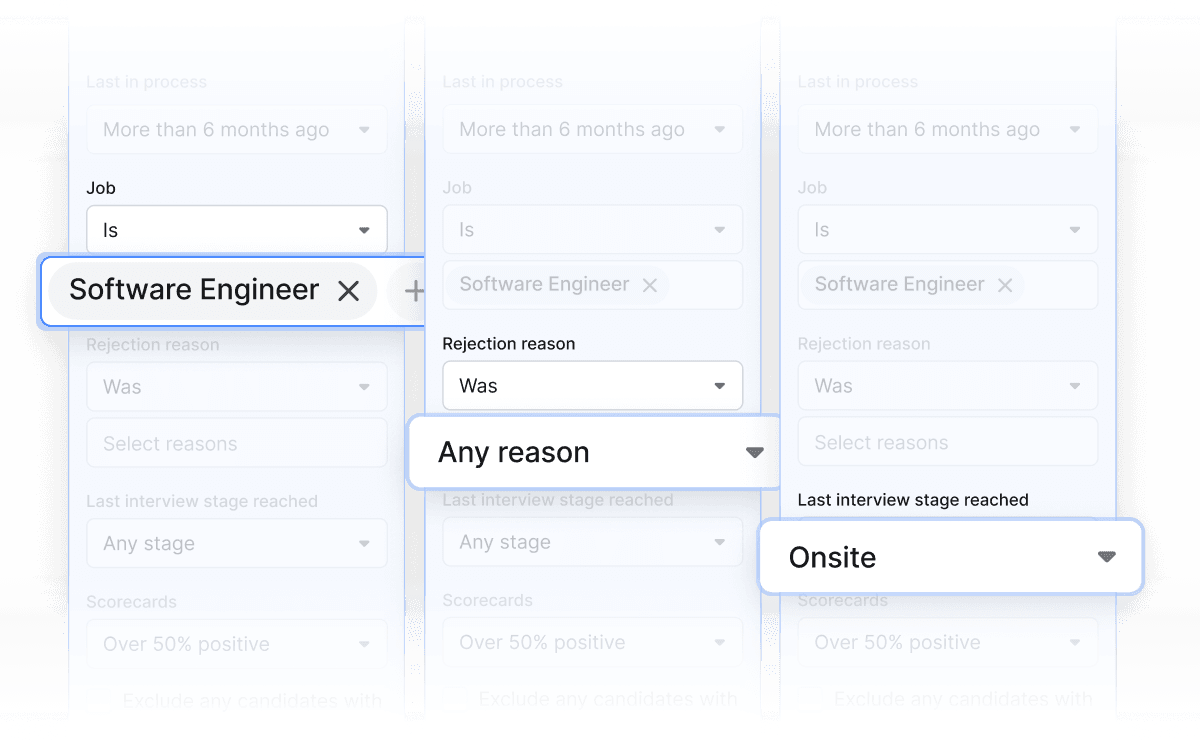

All the while, Gem’s CRM becomes your organization's central source of candidates. It’s worth remembering that your company is already sitting on a veritable goldmine of candidate data—talent who’s expressed interest in your company by applying for roles in the past, many of whom went through an interview process with you. Working with this data can be cumbersome in the ATS (your recruiting team is nodding their heads right now if they’re reading this); but Gem’s powerful search capabilities allow recruiters to surface relevant candidates, rediscover “silver medalists,” and leverage the warm relationships they’ve already built across both the ATS and CRM.

Gem’s Data Refresh automatically updates prospective candidate information every 30 days, supplementing the historical data in your ATS. So when your team does reach out to reengage warm talent, they’ve got all the context they need to do so skilfully. Ultimately, this means your team can source from its own tech stack rather than pay for a handful of third-party candidate source vendors.

“We’ve got a database of over 20,000 people—all technical talent—that we’ve one-click uploaded into Gem, over time, as we’re sourcing from LinkedIn and elsewhere. That’s our general talent pool. In other words, I rarely have to start a search from scratch on LinkedIn anymore—which is a relief, because I find LinkedIn sourcing so frustrating. When a req comes in from a client, I source directly from Gem—talent I’ve already looked at, vetted, and in some cases screened—and queue up my outreach from right within the platform. It’s like having my own more robust, more specialized, more streamlined LinkedIn.”

- Alyssa Garrison, Recruiting Leader & Co-founder @ Techmate Talent

Cut down on IT costs

Software is one of the big buckets Finance leaders are constantly considering when it comes to overall company spend. This is perhaps especially true in uncertain markets, when Finance is suddenly working within the constraints of more finite budgets and has to undergo prioritization exercises. What’s the urgency of spending on this tool specifically, compared to other solutions? One of the most obvious reasons to invest in a new piece of software is if it can replace multiple existing—and collectively more expensive—pieces of software, allowing you to cut down your tech stack and reduce the total number of tools the team is using.

Gem’s sourcing solution has allowed teams to reduce spend on everything from email-finding tools to additional candidate sourcing tools like Fetcher. Gem’s Talent Compass—which offers full-funnel visibility, hiring forecasts, performance metrics, and executive reporting that TA teams use to plan ahead and guide their recruiting strategy—has helped our customers cut spend on everything from kanban boards like TalentWall to analytics solutions like Ashby (Gem’s Talent Pipeline and Talent Compass replace them both in a single, source-of-truth solution).

“With Gem, we eliminated the email-finding tool we’d been paying for and streamlined two tools into one.”

- Shannon Zwicker, Manager, Recruiting Operations @ Cockroach Labs

“Immediately we saw that Gem could replace a lot of the products we were using. It was easily one of the better products I’d seen in terms of streamlining manual work: searching for phone numbers, emails, social media sites. And the cherry on top was that it integrated seamlessly into our ATS.”

- Joe Gillespie, Head of People @ a Stealth Web3 Startup (formerly @ Robinhood)

“Our first solution offered an automated follow-up notion along with a personal email aggregator; but after a year of using them, the data wasn’t good, their algorithm wasn’t good. We created a makeshift solution out of LinkedIn Recruiter before I heard about Gem through word-of-mouth. We ran a free trial and the team immediately loved it. And I just saw productivity increase. So at that point, it was a no-brainer.”

- Angela Miller, Head of Recruiting @ Instabase (formerly @ Pure Storage)

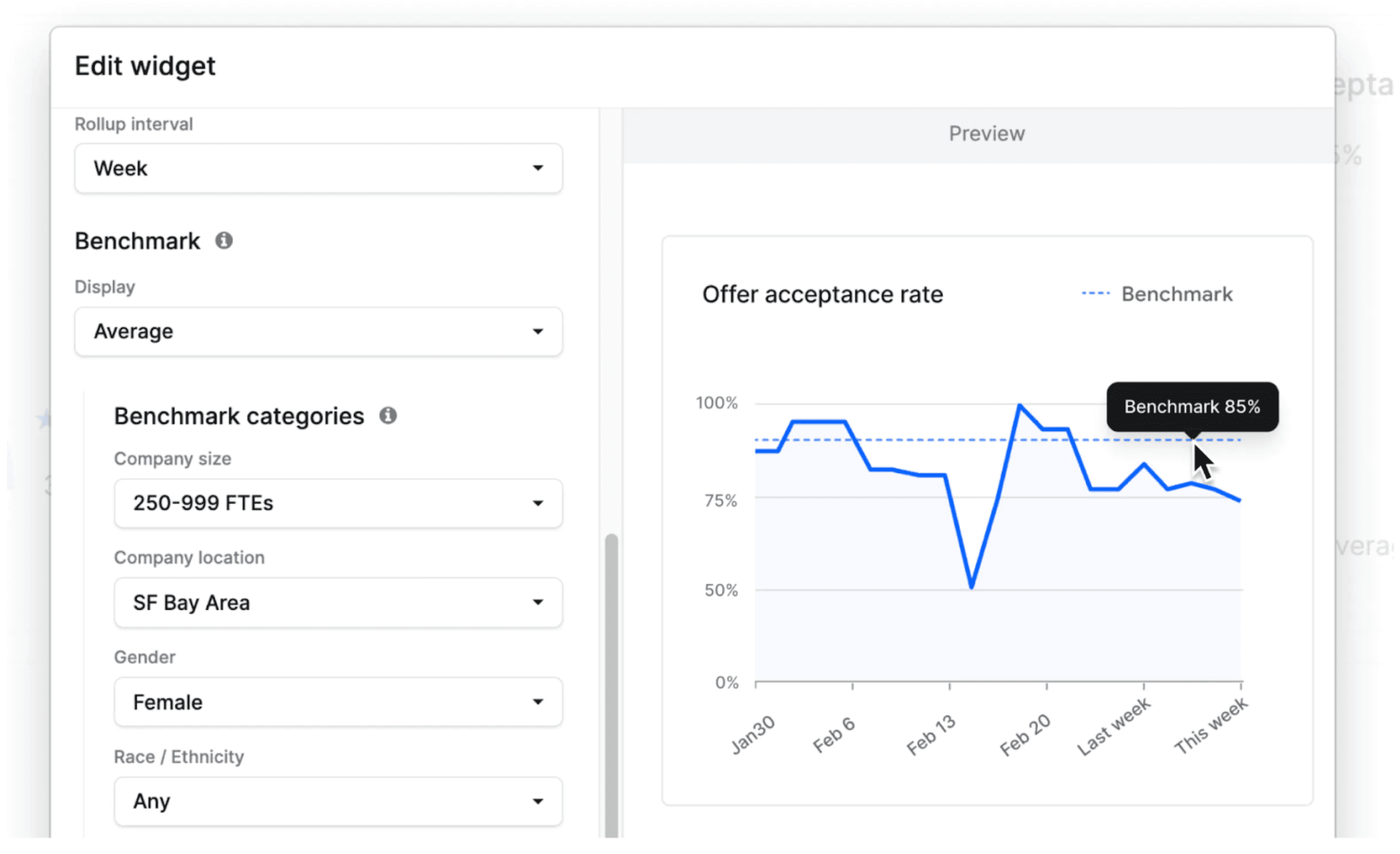

Understand industry benchmarks

As a CFO, you probably know sales efficiency and sales productivity benchmarks really well; but you may be less familiar with recruiting productivity benchmarks. That makes it hard to know how efficient your recruiting team is relative to your peers, and whether you need to invest more or less in TA to hit your hiring goals.

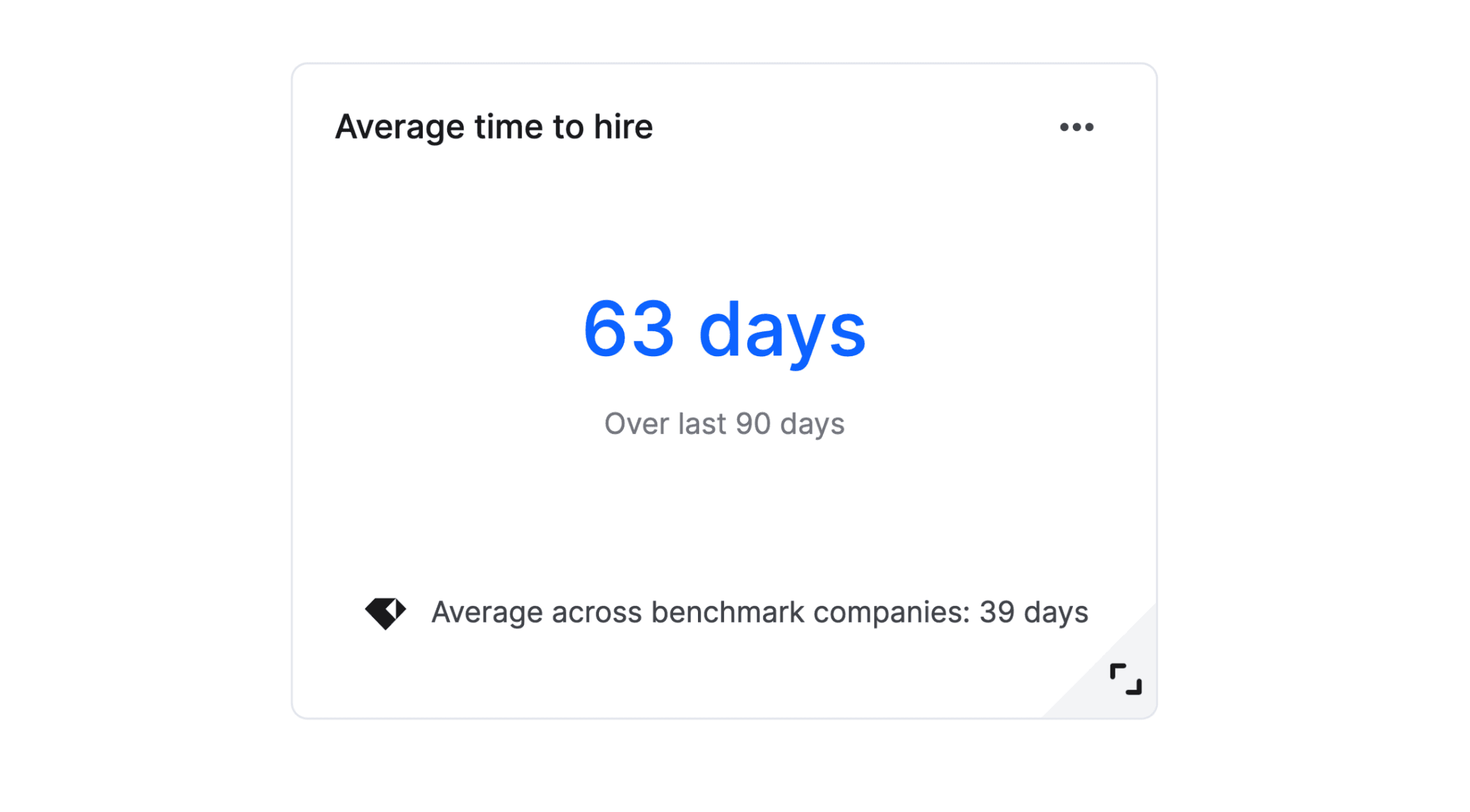

But recruiting benchmarks are powerful because they help CFOs work with talent acquisition leaders to push for more productivity—or for fewer headcount—when thinking through annual planning. Imagine being able to say to your TA partner: “Benchmark data shows that the average time to hire for a role in this department, and at a company of our size, is x days. Based on that benchmark—and given the number of hires we plan to make in Q3—it looks like we don’t need to add any Recruiting headcount right now.”

We suspect any Finance leader would be interested to know how many hires their recruiters are making every quarter relative to other companies of their size, and in their industry, for this reason. It’s why Gem’s Peer Benchmarks can help you understand how you measure up to other teams. (In fact, check out our Benchmark Calculator for a quick glance of time-to-hire and offer-accept rates by department and company size.) Ultimately, this allows for more sophisticated headcount planning decisions.

Decrease time-to-revenue for your go-to-market org—and scale overall hiring quickly to capture demand

(“Finally!” you may be thinking; “a revenue-generating use case.”) Of course, the cost of lost productivity when reqs don’t get filled is most quantifiable for go-to-market or customer-facing roles, though you’re probably working with a set of revenue-per-employee metrics across departments. As a Finance leader, you feel a lot of pain if you can’t forecast your ARR with a high degree of confidence, let alone execute against it. And a key input into your forecasting model is AE capacity. Add up your AEs’ quotas, and that’s essentially your ARR forecast. So if you’re behind on hiring sales positions, you’re at a significant risk of missing your revenue target—which impacts everything down to where you can invest back into the business.

(And by the way, this isn't just about AE roles: your company will always need to be positioned to immediately capture customer demand as it upticks—whether you’re a healthcare company that needs to hire nurses or therapists at scale to service more people and grow revenue, or you’re a B2B SaaS company with an outbound sales-driven model that will need to scale a team of AEs.)

Finance leaders on teams with open go-to-market roles are often the ones building out sales capacity models. Because Gem speeds time-to-hire for these revenue-generating roles (since sourcers source 5x faster with Gem’s automation, those outbound candidates are 5x more likely to be hired than inbound candidates are, and Gem’s analytics help optimize your hiring funnel for candidates in process), it means faster time-to-revenue for your org.

“Our Sales Ops Manager built out a spreadsheet that tracks the sales hiring we need to do from a revenue perspective: I can sit down with Sales Ops and measure activity against hiring date to know how much revenue we’re losing or gaining. All of that comes from Gem’s data, and it’s what my C-levels want to see as well.”

- Carmen Coleman, Head of Talent @ Envoy

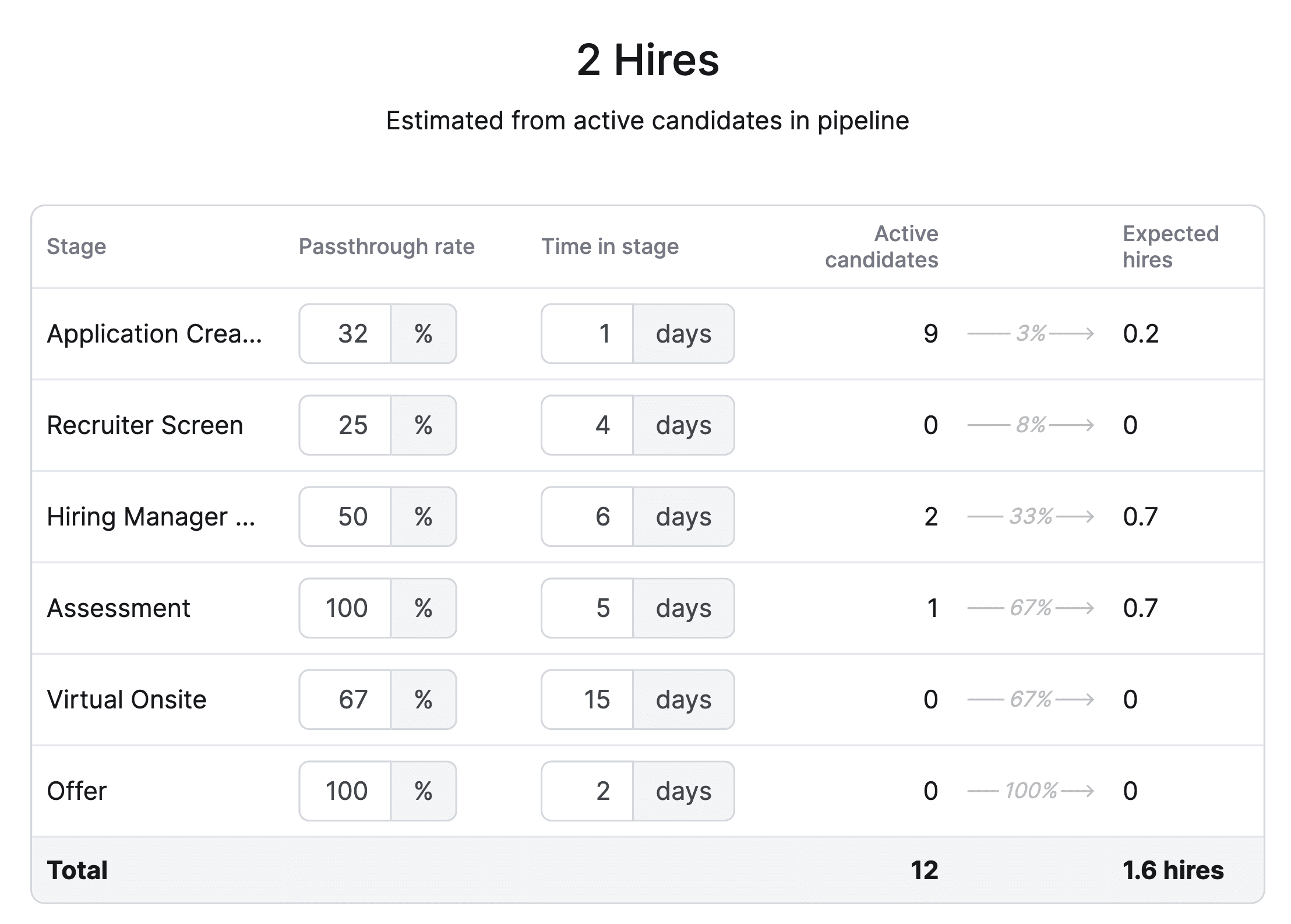

Increase the predictability of forecast spend on new hires

Any organization that’s growing sets quarterly open headcount goals across the company and by department—but many of them don’t get filled on time, which throws off Finance’s cost forecast. There’s often a lot of ambiguity about candidates currently in process: will they be hired this quarter or next (if at all)? CFOs often have to hand-wave, estimate, and apply some buffers: if you’ve got 10 open engineering headcount this quarter and you know you’re typically behind on eng hiring, you’ll apply an arbitrary buffer in your model and assume some of those hires won’t be made on time to create a more accurate forecast. To do otherwise would be to over-forecast the cost.

So an ongoing question for Finance is: of all the open roles we have, how many of those will actually be filled to hit our payroll forecast this month or quarter? Gem’s Expected Hires calculator allows you to see, based on your currently-active pipeline, how many hires you’ll likely yield based on historical passthrough rates and time-in-stage. In other words, you can finally answer the question: do you have enough pipeline now to hit your hiring goals—and therefore meet your payroll forecast?

Overall faster time to hire

Given what we’ve said above about how Gem supports both automation and operational efficiency, this one may be a given. So we thought we’d leave you with some time-to-hire data from our customers:

“With Gem, we made our first hire within two months of signing the contract—and it was around 40% faster than the rest of our hires.”

- Shannon Zwicker, Manager, Recruiting Operations @ Cockroach Labs

“Understanding what our baseline metrics were and then being able to identify opportunities to optimize through Gem drove a 10-day drop in Unity’s time to fill. Last year our average time-to-fill was 75 days. So we set a goal for 70 days, and we’ve been at 65 or lower all year.”

- Emily Russell, Manager, Recruiting Operations @ Ripple (formerly @ Unity Technologies)

“Our time to fill has decreased dramatically. Within the first 30 days of using Gem, we were filling positions that had been open for over a year. In that first month, we hired nine engineers across three countries—talent we’d still be waiting on active applications from if it wasn’t for those automated follow-ups.”

- Jaime Schmitt, Talent Attraction Manager for North America @ Celestica

Share

Related posts

November 7, 2025

Flat teams, growing demands: What our 2025 recruiting survey reveals

October 24, 2025

How to build an effective recruiting capacity plan

August 26, 2025

Why Gem's Workday ATS integration is different and better

Your resource for all-things recruiting

Looking for the latest data, insights, and best practices? Welcome to the Gem blog. We've got you covered.